Best interview questions for your hiring process

Tax Advisor Interview questions

When hiring your next Tax Advisor some of the most important traits to look out for are:

- Organisational skills and a high level of attention to detail. Tax Advisors, of course, tend to deal with a lot of sensitive information and data.

- It’s also going to be essential that you find someone with the correct qualifications.

- Some years experience would be ideal, but it’s not essential with their qualifications.

- Ideally you’ll find someone who is a good problem solver.

- Can look forward to improving tax strategies to improve the company’s finances.

Interviewing a Tax Advisor

Do you need a new Tax Advisor to join the team? Then it will soon be time to get to know the candidates a little better in an interview. With our Tax Advisor interview questions, your interview is prepared quickly and easily.

Please note: Our interview questions are suggestions for the earlier stages of the application process and for candidates with average work experience. They are therefore a little more general.

How to open the job interview

Interviews naturally breed nerves, so the first part of your interview should aim to make the candidate feel comfortable speaking with you, you’ll get much more information out of them and a better sense of the person they are if they feel like they can trust the environment they are in.

To do this you can ask some fun and interesting questions linked to the role, they should be open-ended and encourage conversation.

Best interview questions for your hiring process

See our Tax Advisor Job Description hereFor the interview

A positive opener to start

Why did you choose to work in this industry?

What do you enjoy most about your job?

Behavioral Questions

Why did you choose to become a tax advisor? What do you like most about your job?

How do you usually prioritise and organise your day?

Will give you an idea of their organisational skills, they should be able to structure a few weeks in advance to stay ahead of deadlines.

Could you describe one of the toughest challenges you’ve faced at work?

Strong candidates will show resilience and perseverance when facing a challenge. Bonus points for passion and a sense of pride when delivering results.

Soft Skills

How do you stay up to date with new processes and laws surrounding the industry?

An important question, a good candidate should be passionate and proactive enough to stay aware of any changes they will need to legally implement.

How do you stay on track with different tax deadlines throughout the year?

Time management and organisational skills are really important for someone in the accounting industry. They should be able to prioritise and set goals.

How would you go about teaching a colleague how to use a new tax software if they weren’t well versed in the industry?

This will give you a sense of their communication skills and learning techniques. A great candidate will be comfortable learning a new technology and have a patient approach when teaching others.

Hard Skills

Do you have your accredited certifications?

Of course this question speaks for itself, it’s vital that a tax advisor has the correct qualifications, these depend on your country of residence.

Could you explain the difference between tax accounting and auditing?

This will give you an understanding of their basic experience, this should be an easy question for a candidate to answer.

Could you explain why it’s important for businesses to keep their tax documents for at least 7 years?

A good operational question that should also be easy to answer, this will display their qualifications for the position and demonstrate knowledge.

What accounting software are you most familiar with?

This question is to see how much technical experience the candidate has. There’s no right or wrong answer, but it would be beneficial if they were already familiar with the technologies used in your company.

Operational / Situational Questions

Have you ever discovered compromising information from a tax document? How did you deal with that?

Tax advisors need to keep a lot of information confidential, but they also need to follow a strong code of ethics. A good candidate will show a good thought process with the ability to make difficult decisions. They should understand that it’s their responsibility.

Can you talk about a time that you made a mistake on a tax return? What did you do in that situation?

Again, good problem solving skills and a good level of accountability will go a long way. They should display quick thinking and take action as soon as the problem is realised.

If I am the owner of a small business, what are some tax deductions that you would recommend for me?

Should give examples of relevant reductions to display a good level of experience and knowledge of the industry. Candidates should be well versed with common tax challenges and should be able to come up with a positive solution while consulting.

Start hiring and prepare your interview

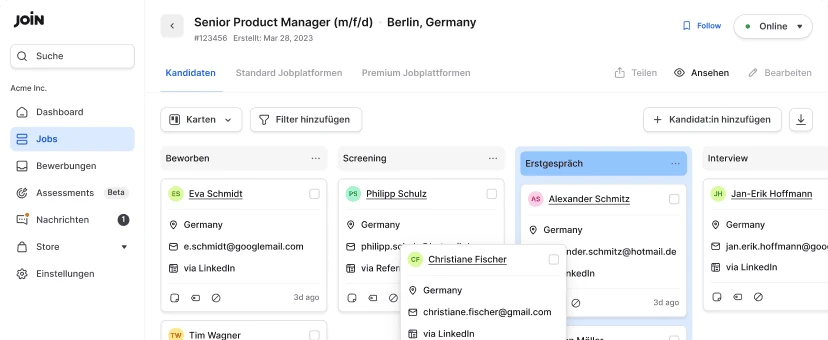

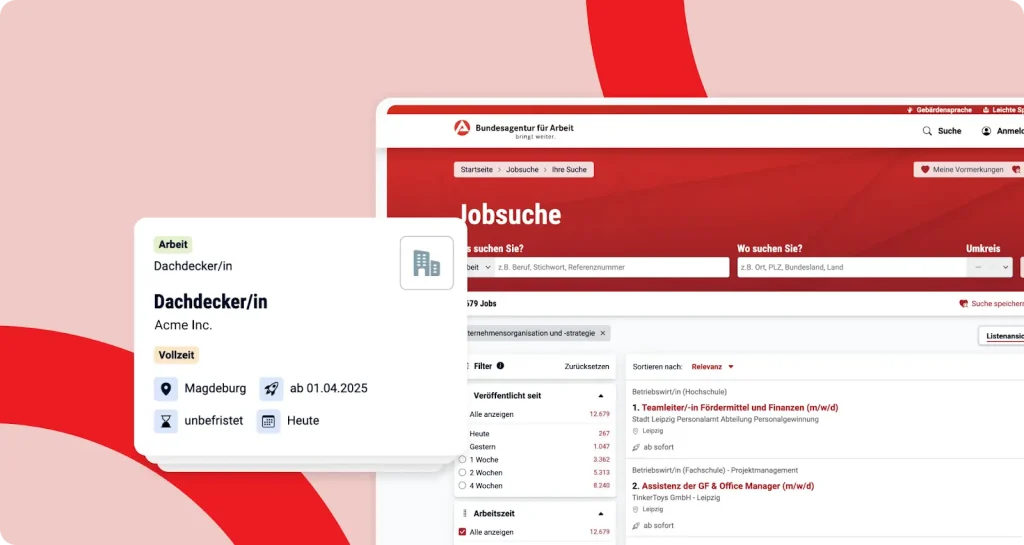

All platforms are available for you to promote your job through JOIN.

Create job ad for free

Gives you some background information and shows a little about their personality.